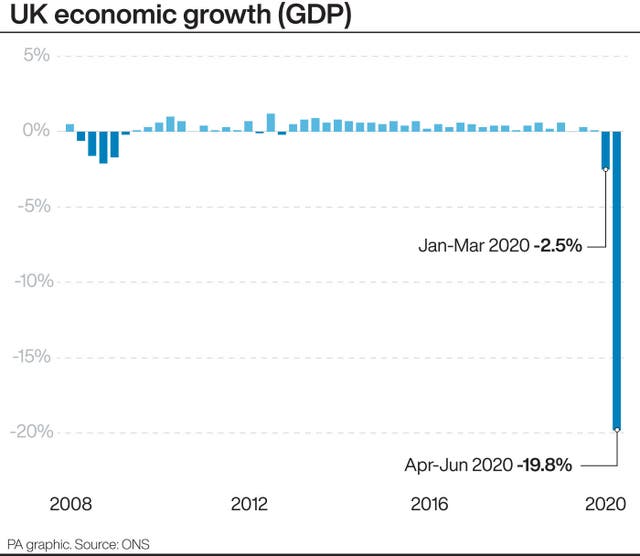

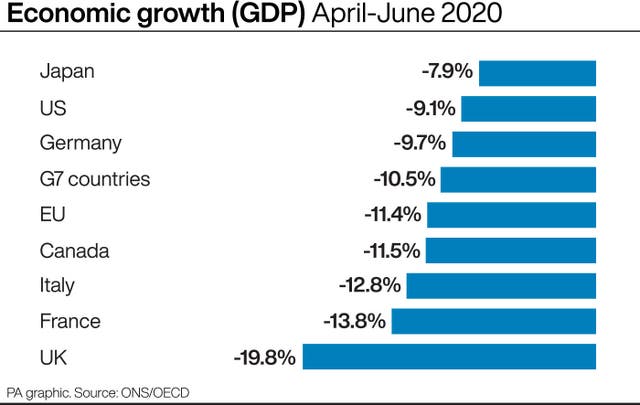

The UK economy’s record contraction in the second quarter was slightly less severe than first thought, but the 19.8% plunge still saw Britain suffer the worst slump of any major economy.

The Office for National Statistics (ONS) revised the second quarter figure from an earlier estimate of 20.4%, while updated figures also showed a steeper contraction of 2.5% between January and March.

It previously estimated that GDP fell 2.2% in the first quarter.

Despite the revisions, the UK still tumbled into the largest recession since current records began and fared worse in the second quarter than any of its advanced economic counterparts.

The ONS said: “While it is still true that these early estimates are prone to revision, we prefer to focus on the magnitude of the contraction that has taken place in response to the coronavirus pandemic.

“It is clear that the UK is in the largest recession on record.

“The latest estimates show that the UK economy is now 21.8% smaller than it was at the end of 2019, highlighting the unprecedented size of this contraction.”

Since the nadir of the recession in April, GDP has now grown for three months in a row, but has only made up around half of the ground lost during the pandemic, according to the ONS.

The Bank of England’s chief economist Andy Haldane said separately on Wednesday that GDP is expected to break records again by growing 20% in the third quarter, though he added the recovery had slowed a little during August and September.

Figures from the ONS showed the lockdown saw a record-breaking 23.6% fall in household spending between April and June, which economist Samuel Tombs at Pantheon Macroeconomics said was “at the root of the UK’s underperformance”.

Forced to stay at home during the lockdown, Britons ramped up their savings instead of spending – sending the household saving ratio soaring to an all-time high of 29.1% in the second quarter.

This was up from the 9.6% saving ratio in the first three months of the year, according to the ONS.

Mr Tombs said: “Households’ spending appears to have rebounded strongly in the third quarter, as they spent some of the ‘enforced’ savings they accumulated in the second quarter.”

But he added: “The still-low level of consumers’ confidence, which has been weighed down by rising redundancies and the emerging second wave of Covid-19, suggests that households’ saving rate will return in the fourth quarter to a level much higher than seen before the virus struck.”

Howard Archer, chief economist at the EY Item Club warned these factors meant the final three months of 2020 will be “more challenging for the UK economy and growth may be limited”.

But in some cheerier news for the UK economy, ONS data also showed Britain’s current account deficit fell to its lowest level for nine years, at £2.8 billion or 0.6% of GDP, down from £20.8 billion in the first three months of 2020.

While this was due to slumping global trade amid the pandemic and is expected to widen again, Mr Archer said it was a “particularly welcome development for the UK”.

Comments: Our rules

We want our comments to be a lively and valuable part of our community - a place where readers can debate and engage with the most important local issues. The ability to comment on our stories is a privilege, not a right, however, and that privilege may be withdrawn if it is abused or misused.

Please report any comments that break our rules.

Read the rules hereLast Updated:

Report this comment Cancel